After years of relying on the same methods, digital marketing agencies and businesses are now being challenged to pivot and adapt (some more quickly than others, depending on their existing strategies).

At the heart of this shift is AI search, currently dominating the conversation in digital marketing circles.

This shift has and continues to generate considerable uncertainty, leading to concern for many clients. Much of this anxiety stems from misconceptions or a lack of clear understanding.

To address this, we’ve put together this simple overview to clearly explain what AI search is, how it’s reshaping search marketing, its impact on SEO practices, and the practical steps that can be taken at this stage to remain competitive right now.

What Are AI Overviews?

AI Overviews represent Google’s innovative approach to delivering search results by using artificial intelligence to generate concise summaries, directly within the search results page.

This AI-powered LLM feature leverages sophisticated language models to provide instant, contextually relevant answers to user queries.

Where and How AI Overviews Appear:

- AI Overviews appear prominently at the very top of search results, above traditional organic listings.

- Visually, they resemble enhanced featured snippets or brief summaries, with an aim to quickly inform users without requiring additional clicks through to websites.

- They include citations and links to relevant web pages, facilitating deeper exploration if needed.

AI Overviews first started showing up for more complex questions but now they’re popping up more regularly, showing that Google’s really leaning into an ‘AI-first’ approach where quick, clear answers take priority.

How Do AI Overviews Work?

Google’s AI Overviews use the Search Generative Experience (SGE), combining advanced language models (LLMs) and traditional search index data.

When users type a question in search, Google’s AI rapidly interprets the intent, synthesises data from authoritative web sources, and generates concise answers.

The process involves:

- Query Analysis: Identifying exact user intent and nuances behind queries searches.

- Content Gathering: Extracting relevant, authoritative content from indexed sources.

- Dynamic Synthesis: Generating succinct, accurate responses using natural language.

- Continuous Adaptation: Regularly updating and evolving the content based on new information and user interaction.

This means content creators need to focus less on just getting clicks and more on becoming trusted sources that Google’s AI will want to use.

How to Rank in AI Overviews, in Google Search Results

Ranking in AI Overviews marks a shift from traditional SEO practices. The fundamentals remain important, but the way they are applied is changing significantly.

1. The Importance of High-Quality, User-Centric Content

Google’s AI favours content that directly addresses users’ queries comprehensively and clearly.

- Craft content that explicitly and simply answers user questions.

- Ensure content is accurate, detailed, updated, and easily digestible.

- Structure content logically, using clear headings, lists, and bullet points.

2. Authority Building is Crucial

Authority is now paramount. Google’s AI models give preference to sites demonstrating expertise, reliability, and topical depth.

- Publish authoritative content regularly on focused topics.

- Highlight your authors’ credentials and expertise.

- Secure backlinks and mentions from trustworthy, respected sources.

This is a good time to highlight how Digital PR is now more important than ever when it comes to building authority online.

As Google’s AI overviews pull from sources it deems trustworthy and reputable, earning coverage and backlinks from well-known publications, industry blogs, and high-authority domains can make a huge difference. Digital PR not only improves your website’s authority signals in Google’s eyes but also increases your chances of being referenced in AI-generated summaries.

It’s no longer just about having great content, it’s about making sure that content is validated by other respected voices across the web. In short, digital PR amplifies your expertise and visibility, helping AI choose your content as a credible answer.

3. Keywords and Key Terms Still Matter

While exact keyword matches matter less, well-chosen semantic clusters and key phrases remain critical for signaling relevance.

- Focus on intent-driven, natural-language keyword clusters.

- Incorporate conversational phrases and commonly asked questions.

- Ensure alignment across metadata, headings, and body text.

4. The Importance of Tracking Rankings and Impact

Traditional ranking metrics alone are insufficient; visibility within AI Overviews needs distinct tracking methods.

- Monitor appearances in AI Overviews specifically.

- Track shifts in visibility, citations, and zero-click traffic.

- Use analytics to measure brand exposure beyond just organic click-throughs.

Is SEO Still Important?

YES, SEO remains fundamentally critical. AI search and AI Overviews don’t eliminate SEO; they amplify the need for well-executed SEO strategies.

Why SEO Remains Vital:

- AI-generated summaries rely heavily on optimised, structured, authoritative content.

- Even without clicks, SEO visibility significantly enhances brand authority and recognition.

- Structured data and technically sound SEO provide foundational support for AI and traditional search results.

AI overviews aren’t replacing SEO; rather, they build upon robust SEO practices.

SEO strategies now must focus on:

- Comprehensive content optimisation for both AI-driven and traditional search.

- Strategic use of structured data and semantic relevance.

- Ensuring authority, credibility, and content excellence.

Impact on User Behaviour & Organic Traffic

AI Overviews significantly impact user behaviour by delivering concise, accurate answers directly on Google’s results page. With simple questions answered upfront, many users no longer need to click through to websites, causing a shift in how organic traffic behaves.

Here are some key effects you’ll notice:

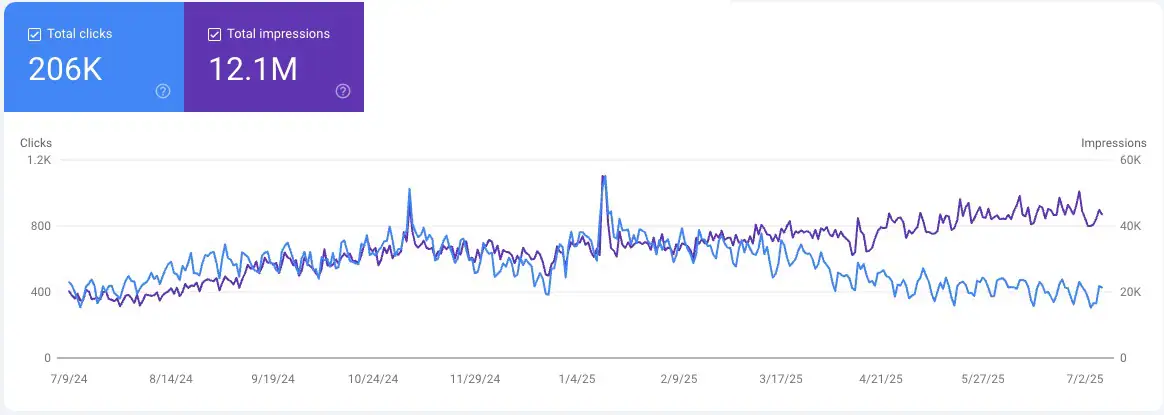

Higher Impressions, Fewer Clicks

Your content may frequently appear in AI Overviews, significantly boosting your overall visibility or impressions. Because these AI-generated answers satisfy basic user questions immediately however, fewer people click through to traditional organic results.

Lower Click-Through Rates (CTR)

Standard search listings, particularly content like FAQ pages, informational blog posts, and basic guides, often get pushed further down the page beneath AI summaries. As a result, even if your content still ranks highly in traditional results, you’ll likely experience a measurable decline in CTR.

Improved Visit Quality

Though overall click volumes might decrease, the quality of the users who do click through often improves. Users who bypass AI-generated summaries typically have stronger intent, seeking more detailed, in-depth information or specialised services. This means these visitors are often more engaged and more likely to convert.

This shift is driving substantial changes in SEO and content strategies. Businesses must now pivot toward creating more authoritative, in-depth content designed to capture high-intent users who move beyond initial AI Overviews in search of deeper insights or actionable solutions.

Staying Competitive in AI-Driven Search

For sectors like financial services, healthcare, and businesses where trust and expertise are critical, AI-driven changes to search are a significant evolution, but not a disruption to SEO fundamentals.

Users increasingly expect instant, relevant, and authoritative information, reinforcing the necessity for outstanding content and SEO practices.

To thrive:

- Prioritise content quality and authoritative depth.

- Adjust tracking methods to better capture AI-driven visibility.

- Understand and leverage Google AI Ads strategically.

- Continuously refine your SEO foundations to accommodate evolving AI trends.

At Woya Digital, we’re adapting to these shifts, ensuring our clients remain visible, credible, and competitive in the rapidly evolving search landscape.

Ready to adapt your strategy for AI-powered search? Contact us to discuss how Woya Digital can help you succeed.